Delaying capital gains taxes during saving for FIRE phase

It is common knowledge that one should delay realizing their capital gains as much as possible (especially when aiming for Financial Independence / Early Retirement). Let’s focus on the phase, when one saves for FIRE, and see the magnitude of the effect of such a delay.

Disclaimer

Everyone has their own unique situation. This post is based on a number of assumptions, thus, don’t rely on it as is. Have a look at the assumption and see how well this applies to your situation.

Prelude

It is commonly known that usually one should delay realizing their investment capital gains as much as possible to increase their returns. Basically, instead of just paying the tax now, one can temporarily keep it and continue getting investment growth (compounding) out of it.

Simulation

Assumptions

Let’s take an example of Annet. We will use the following assumptions about Annet and her life:

- lives in Germany

- pays German capital gain tax and always 26.375% (25% tax itself & additional 5.5% of it as solidarity tax)

- has other income, i.e. the capital gain tax is never reduced to progressive income tax. This is a strong assumption, but not for the collection phase

- never uses 801 tax-free capital gain

- no dividends and no tax prepayment (this is different from the current German system)

- starts from 0 in January 2019

- (the strongest assumption) the market always has constant yearly and monthly returns. I use 4% return per year or equivalently 0.32737% per month.

- earns 2k EUR and invests 1k EUR each month.

Methodology

We assume that Annet contributes 1000 EUR every month. Her investment growths by 0.32737% at the end of every month. I.e. she has 0 at 1st of January 2019. She invests 1000 in the end of January. In the end of February her 1000 grow into 1003.27 and she invests another 1000, thus, having 2003.27 pre-tax overall.

Now we compare 2 options. The first option is delaying realizing capital gains as much as possible. Basically she never sells until becoming FIRE. At that point, she will pay 26.375% on her capital gains. The second option is realizing capital gains as fast as possible (every month, alternatively having only distributing ETFs). Basically, once her 1000 grow into 1003.27, she immediately sells them (or receives dividends) and buys the same asset again. While doing this, she pays 26.375% tax on the growth.

Note: This is just a simplified model. Re-buying the same asset might be considered a wash sale.

Also normally one does not sell everything after becoming FIRE, but here we assume this to be able to compare the two approaches.

Spreadsheet

I’ve prepared a Google Spreadsheet with the calculation. You can play with it by making a copy first.

Results

According to 4% rule, her FIRE target is 300k. In the first case, she reaches 300k (after tax) in 222 months (July 2037) and pre-tax she has 327k. In the second case she has only 294k EUR at this point (i.e. 1.7% less). She needs 4 more months (1.8%) to reach 300k EUR post-tax in the second case.

General case

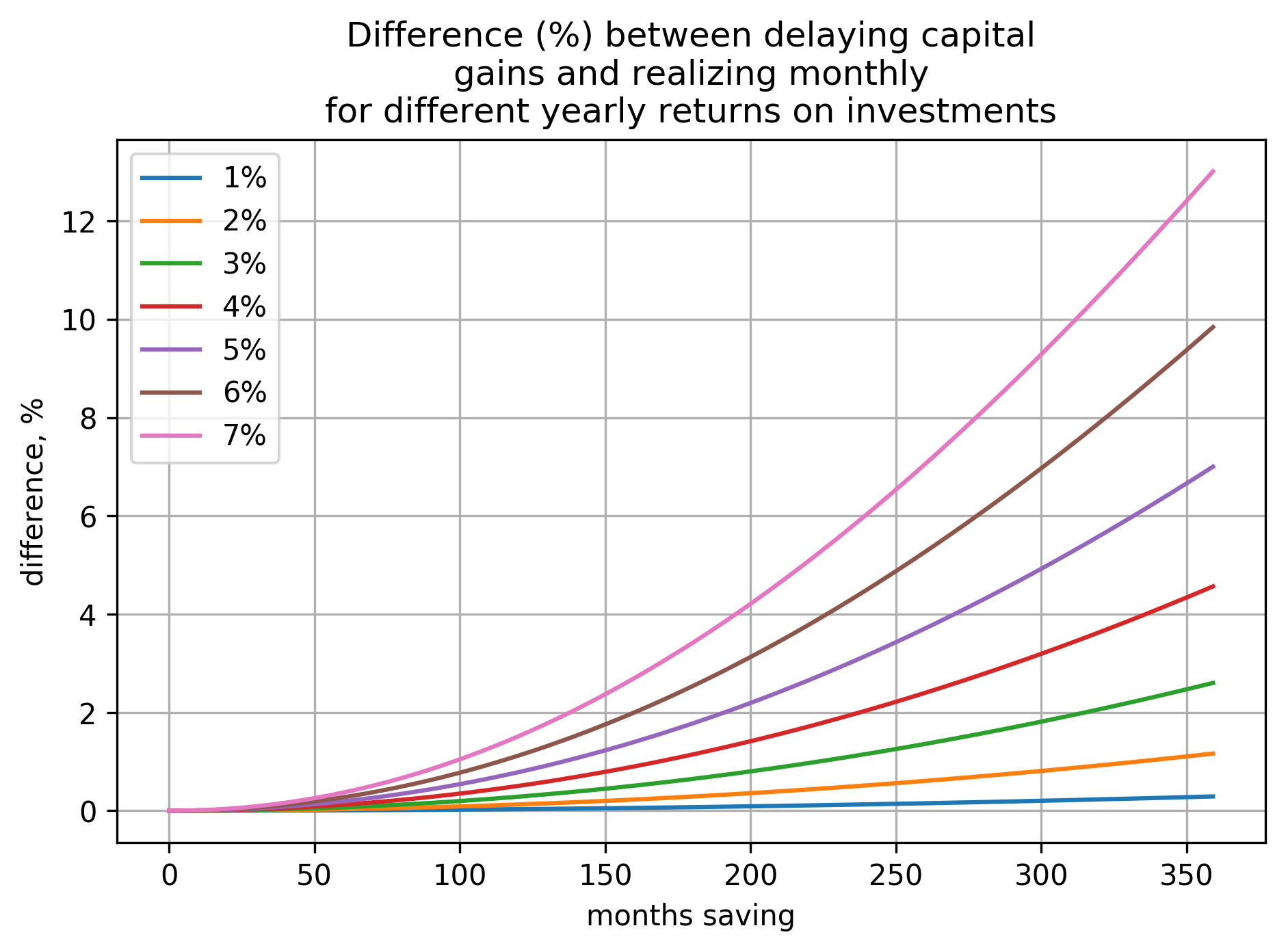

Above we considered only one particular setting. Now let’s have a look how the two cases differ under various yearly investment returns and time horizons.

As we can see, for 7% yearly return and 30 years, the difference crosses 12%, which is a substantial amount.

Further research

Possible improvements of the simulation:

-

take into account 801 EUR capital gain tax free every year. This won’t affect the result too much though as we have already seen in my previous post about tax-free 801 EUR per year. Basically, this can improve the second case (realizing gains immediately), but at most 801 * 0.26375 = 211.26 EUR per year.

-

look into FIRE spending phase, which is much more dependent on capital gains. In this simulation we pretended that we send everything once one reaches FIRE to compare the two cases. In reality that’s not true. In this case not-realized capital gains will have even more time to grow, thus, this should make the difference even larger.

-

take into account capital gain tax becoming progressive income tax. Finally, this should reduce the tax paid after FIRE substantially. Basically, if one has no or little income and their progressive income tax is less than 25%, they don’t pay 25% on their capital gains either (but their income tax instead).

-

using real market data. Currently I just assume 4% per year growth, which ignores sequence of returns completely.

-

taking into account yearly tax prepayment.

I will address some of these in my follow-up posts, stay tuned!

Conclusions

Delaying your capital gains matters less than I expected (1.7% difference under 50% saving rate and 4% yearly return case). However, since by default you don’t realize them, it is better not to do anything extra and just don’t lose these 1.7%. Overall, 1.7% (or even more if the yearly return is larger than 4%) can be a reasonable sum.

Occasionally one can be forced to realize their capital gains (e.g. an accumulating ETFs gets closed or changes its internal structure). Based on the numbers above, it makes sense to try to avoid this to some extent (e.g. buying same ETFs from different providers).