801€ tax free capital gains each year in Germany

In Germany, one does not pay any tax for their first 801€ of capital gains each year. I personally try to realize at least 801 EUR each year to use this benefit, but I am now curious how much of a difference in the long term this makes.

Disclaimer

Everyone has their own unique situation. This post is based on a number of assumptions, thus, don’t rely on it as is. Have a look at the assumption and see how well this applies to your situation.

Prelude

I met some people who did not bother with these 801€ per year at all. However, I do try to use them. Basically, when realizing 801€ of capital gains, one pays no taxes in Germany. Please note that this does not mean that one gets 801€ for free. Nope. Normally one would pay 26.375% tax (25% capital gain tax and 5.5% of that is solidarity tax). With this benefit one does not pay this tax for 801€. Thus, one can get free 801 * 26.375% = 211.26€ each year by doing this. This is definitely not a life changing sum, but I am curious what the impact is when saving e.g. for FIRE.

Dividends do count against this sum as well. Moreover not realized capital gains now have to be partially realized up to basic interest rate (Basiszins) each year which goes against these 801€ as well.

Simulation

Assumptions

Let’s consider Jannet. We will use the following assumptions about Jannet and her life:

- lives in Germany

- does not have any other capital gains except from her stock portfolio

- has other income, i.e. the capital gain tax is always 26.375% and never gets replaced with the progressive income tax (in a future post I will look more into how this works). This is very realistic for the collection phase

- starts from 0€ in January 2019

- (the strongest assumption) the market always has constant yearly and monthly returns of 4% and 0.32737% respectively.

- earns 2k€ and invests 1k€ each month.

Methodology

As we assumed above, Jannet contributes 1000€ every month to her portfolio. Her investment grows by 0.32737% at the end of every month. I.e. she has 0 at 1st of January 2019. She invests 1000€. In the end of February her 1000€ grow into 1003.27€ and she invests another 1000€, thus, having 2003.27€ overall pre-tax.

Now we compare the two following options. The first option is to never realize capital gains during the savings phase. I.e. she has 2003.27€ pre-tax and she does nothing. The second option is to realize capital gains up to 801€ per year, in order to use this tax benefit. I.e. she would immediately realize these 3.27€ and have 2003.27€ already taxed. At some point she will reach 801€ for this year and stop realizing capital gains to delay paying capital gain taxes into the future (there will be a post on how this delaying affects the investment growth).

When we compare the two approaches, we always compare post-tax sum. I.e as if Janet sold all her investments at that months. Here we take into account 801€ in both approaches.

Spreadsheet

I’ve prepared a Google Spreadsheet with the simulation. You can play with it by making a copy. The simulation inputs are all the way on the right.

To be honest, making the spreadsheet was quite tricky. I had multiple mistakes at first and had to compare the numbers with my python simulation to fix them. As a result, the spreadsheet is quite complicated and may be hard to follow. However, the most interesting field is diff percentage (i.e. difference in percents between the two options). There are also actual overall savings after tax for each months (columns adjacent to the diff column).

Results

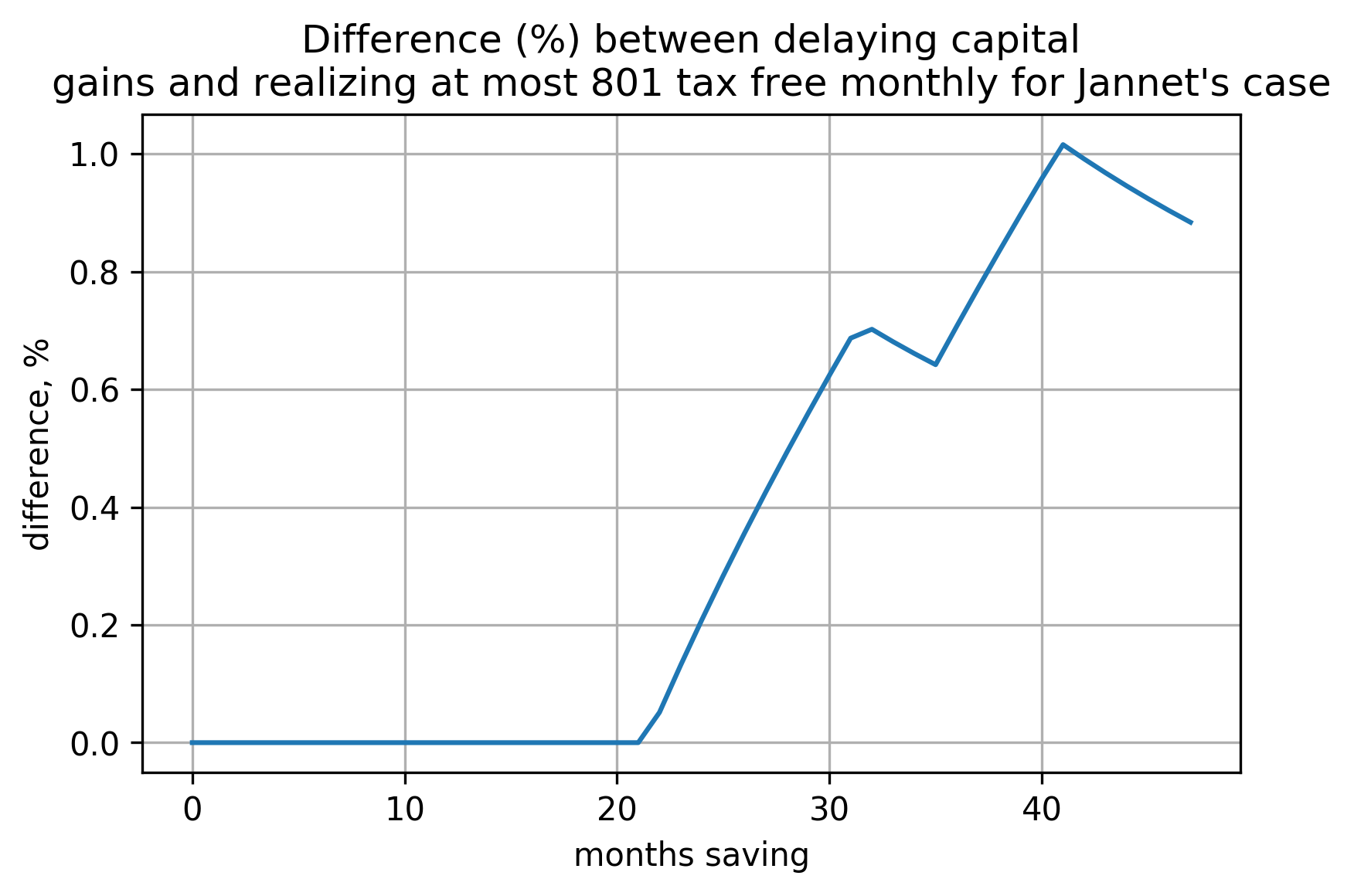

According to 4% rule, Jannet’s FIRE target is 300k€. In the first case, she reaches 300k€ after tax in 222 months (July 2037) and pre-tax she had 327k. In the second case she reaches 300k€ after tax 2 months earlier (May 2037). By this time she had realized 14542€ of capital gains tax free by using this 801€ benefit. I.e. she has got 14542€ * 26.375% = 3835.45€ for free.

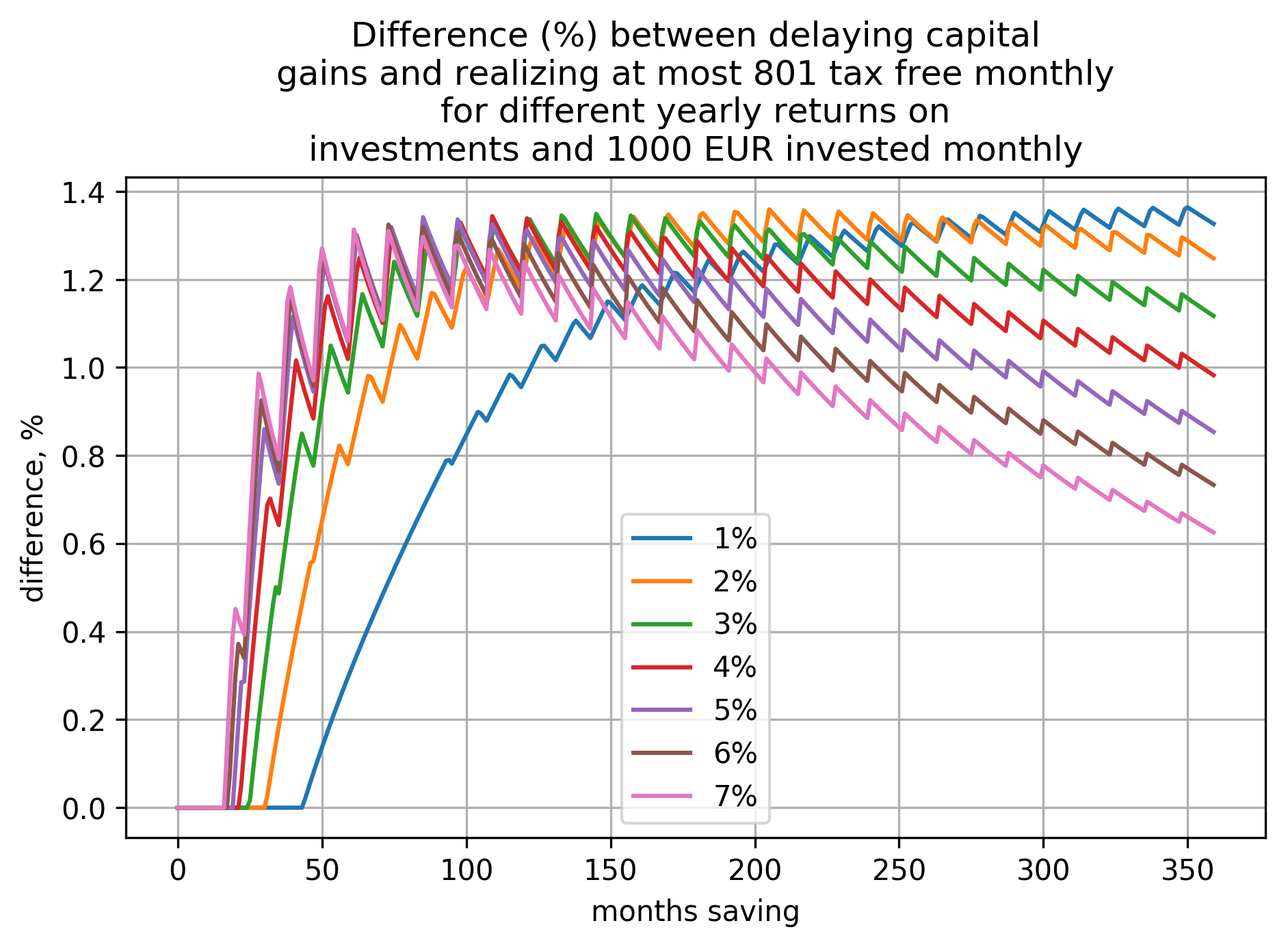

The difference between the two approaches (in percents) jumps to 1.34% and then slowly falls down to ~1.2%.

Let’s plot the difference for each month:

It does look peculiar and we can make a number of observations.

First, for some time the difference stays at 0. This happens before Jannet’s overall capital gains reach 801€. This is just a consequence of me applying this 801€ bonus when calculating the final amounts saved in both cases. For example, in May 2019 the investment growth is 32.84€. In the first case, these are fictitiously realized before the comparison. In the second case, they are realized each month. In both cases, Jannet pays no tax on these 32.84€, because of 801€ tax-free benefit.

Second, we observe a peculiar unexpected sawtooth pattern. This can be explained by the yearly nature of this 801€ tax benefit. In January each year, the 801€ counter is reset. As a result, before Jannet uses this limit completely the difference grows. However, once Jannet exhausts these 801€ for a given year, the difference stops growing and actually relative percentage starts slowly decreasing. This happens because the mixed tax sum (sum of already taxed and not yet taxed parts) is the same in both cases. Whether a gain is taxed or not does not impact capital gains obtained from it. As a result, the investment growth in both cases is exactly the same. Then in the next January, 801€ counter is reset again and the difference grows for some months.

We can compare the plot with the spreadsheet to see precisely how this happens. In month 32, Jannet exhausts 801€ for the first time. As a result, for the remaining months in this year (33-35) the difference falls. Then the 801 counter gets reset and the difference starts growing again (months 36-41) until it gets exhausted again.

General case

Above we considered only one case - investing 1000€ monthly @ 4% yearly return. Both variables affect the result, e.g. if we invest 10k€ monthly, the effect of exactly the same old 801€ becomes much smaller. Also, if the investment grows faster, this will decrease the difference as well.

Thus, let’s have a look how the difference between the two approaches depends on yearly returns, monthly investment amount and time saving.

We start by extending Jannet’s case (1000€ monthly @ 4% yearly growth) to various yearly investment returns (1-7%):

As we can see, for approximately all yearly return value the difference reaches around 1.2% and the starts to fall down. The speed of the decrease is larger for higher yearly returns, as we already predicted above.

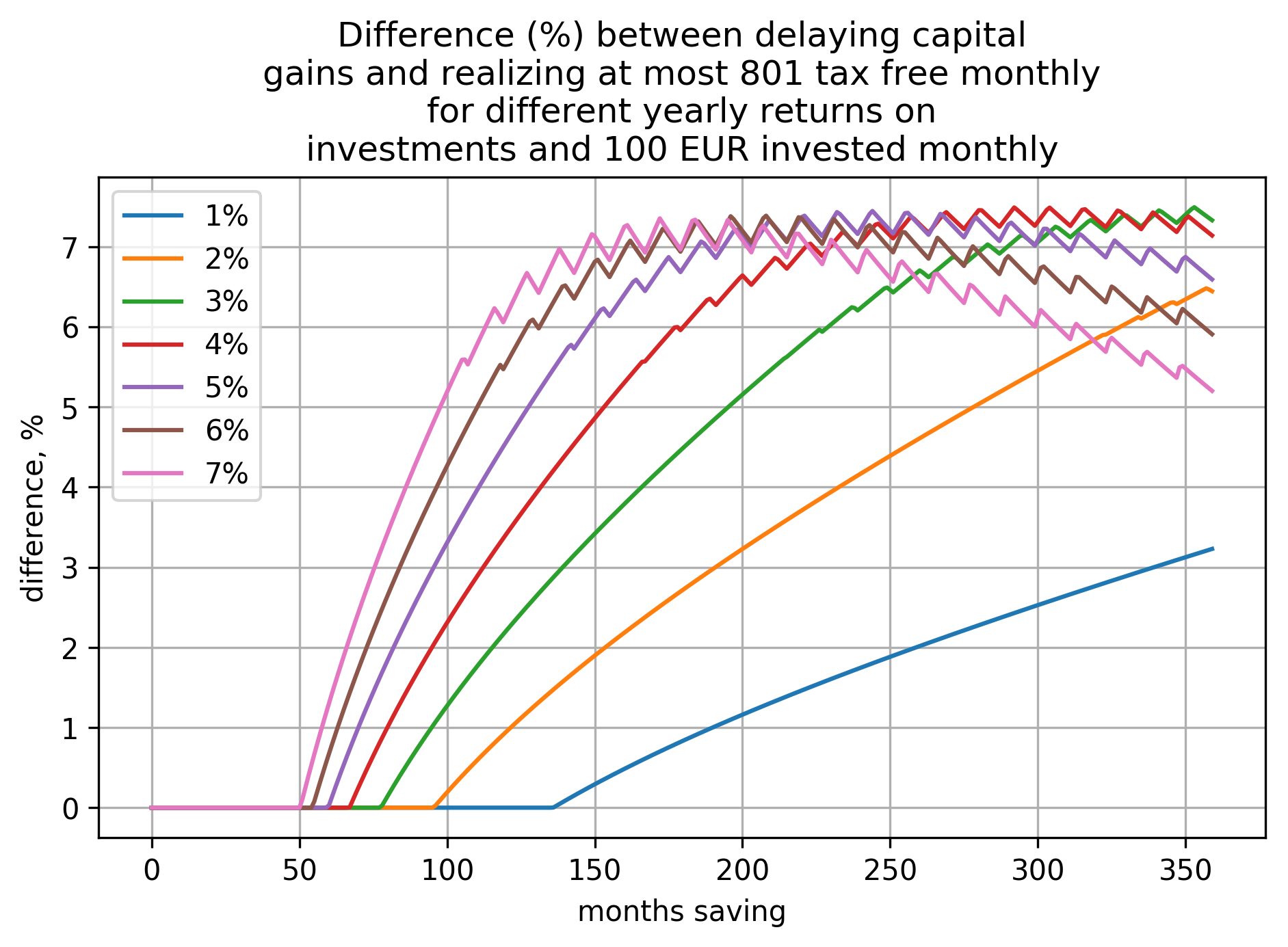

If we look at investing 100€ per months:

The observed difference gets much more substantial and reaches 7% at a peak. This is natural, since 801€ is a substantial amount of money, when one invests 100€ per month.

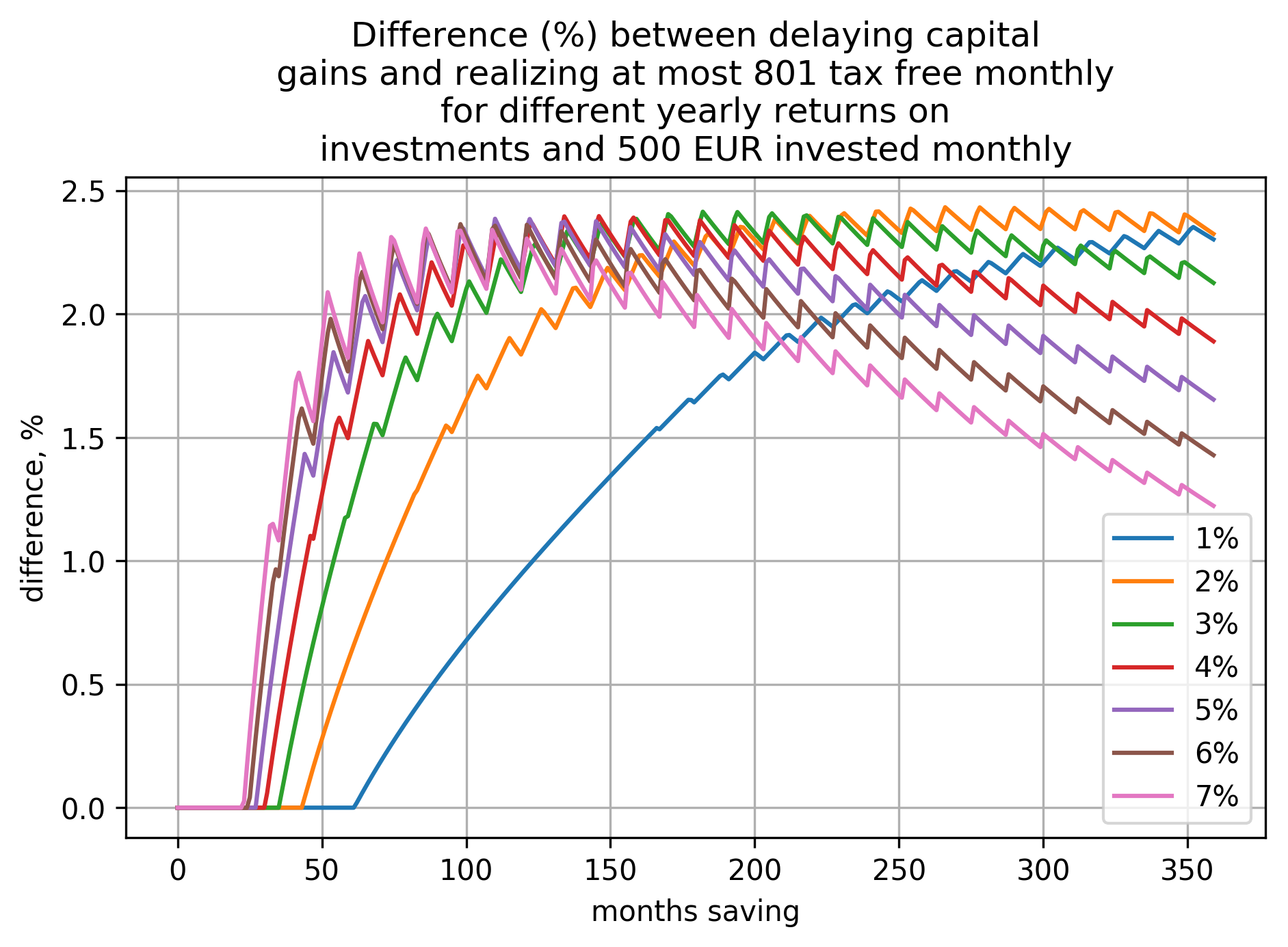

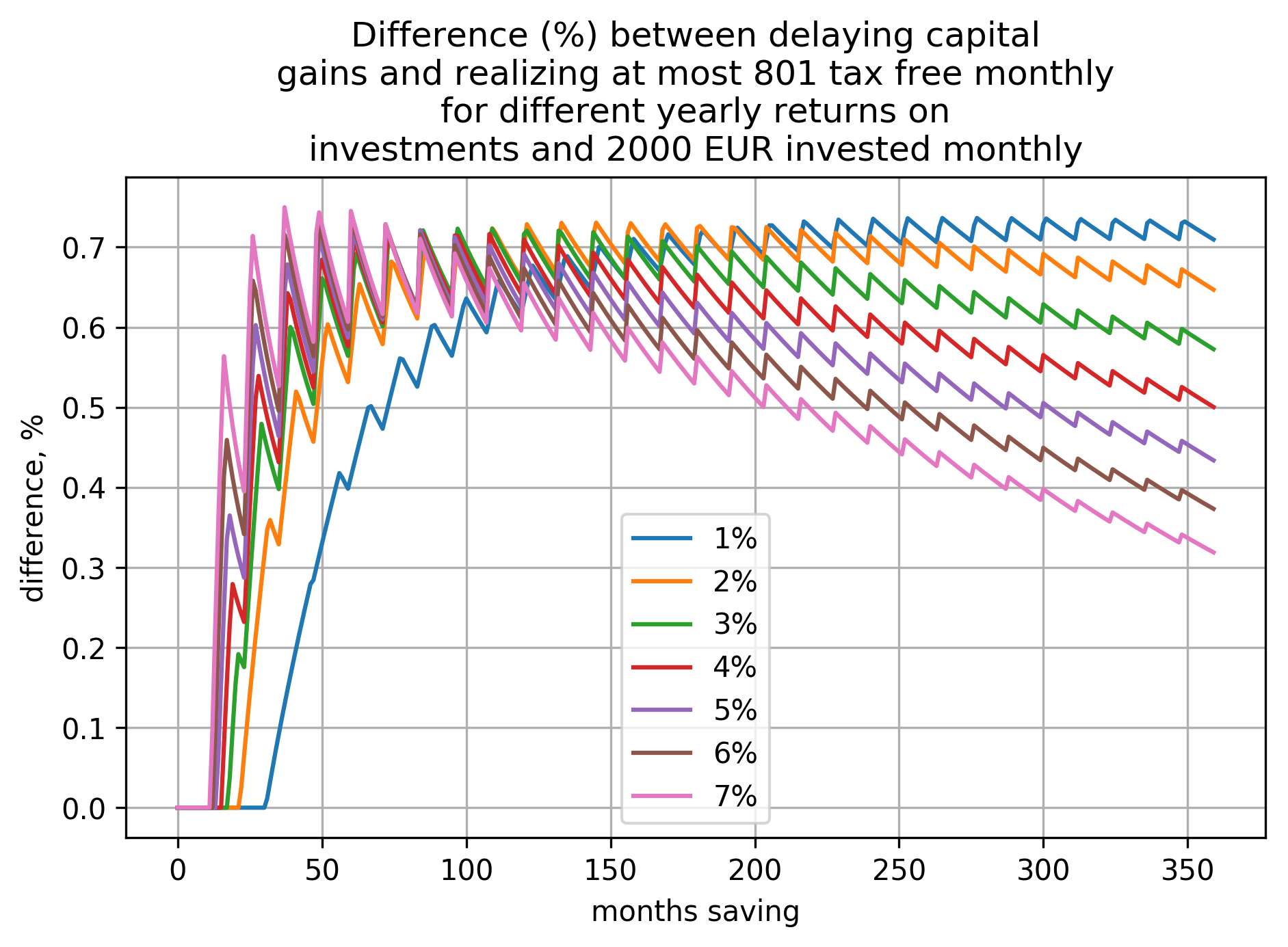

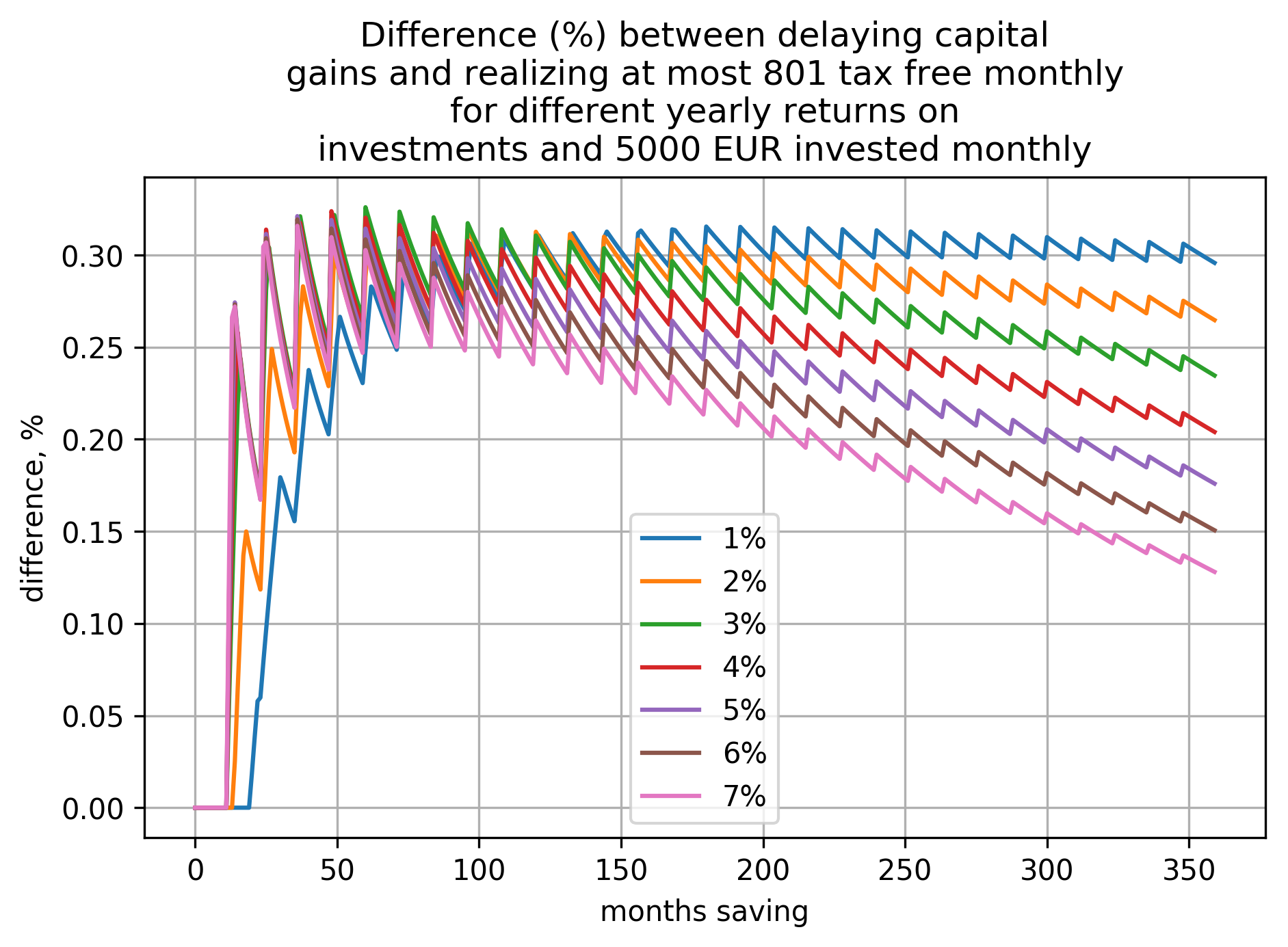

The remaining plots for 500, 2000 and 5000€ invested per month you can see in the appendix below.

Further research

Possible improvements of the simulation:

- look into FIRE spending phase, which is much more dependent on capital gains.

- take into account capital gain tax becoming progressive income tax.

I will address some of these in my follow-up posts, stay tuned!

Conclusions

The 801€ tax free capital gains per year do matter! You can get additional 1.2% post tax when investing 1000€ monthly @ 4% yearly by realizing at most 801€ tax free each year. If you invest less, e.g. 100€, the effect becomes even more dramatic and the difference can reach staggering 7%. And if you invest something like 5k€ per month, the difference reaches 0.3%.

Overall, these are free money, which are very easy to get. Thus, I advise you to use this opportunity!

Please note that there are multiple ways to use it. In the end, you just need to realize capital gains and I am aware of the following ways to do so:

- Receive dividends. If we assume 1-2% of dividends per year, you will use these tax-free 801€ by having 40k-80k€ invested.

- Yearly tax prepayment (Vorabpauschale).

If we take 0.87% Basiszins for 2018 and assume 4% yearly growth, having 801€ / (0.87% * 70% * 70%) = ~187k€ already exhausts these 801€. - Selling something with a win.

Thus, if you have 187k and the year is positive (i.e there was at least Basiszins * 70% * 70% growth), you don’t have to do anything to realize these 801€. If you have only distributing assets, having 40-80k€ is already enough. Otherwise, you can sell something with a win.

Happy realizing 801€ of capital gains each year!

Corrections

2019/07/22:

- Previously it was assumed that solidarity tax was 5%. It is actually 5.5%. I.e. one pays 25% * 1.055 = 26.375% capital gain tax. All values and graph have been updates. Thanks to u/hn_ns on Reddit for this correction.

- On Reddit it was pointed out that one can use these 801€ via dividends or Vorabpauschale. I updated the text to make this explicit.

2019/08/24:

- Previously it was assumed that Vorabpauschale was calculated as Basiszins * 70%.

It is actually Basiszins * 70% * 70%:

- Basisertrag = Cost at the beginning of the year * Basiszins * 0.7

- Tax = Basisertrag * (1 - Teilfreistellung)

- For stock fonds, Teilfreistellung = 0.3

Thanks to u/hn_ns on Reddit for this correction. Also other sources: 1, 2.

Appendix